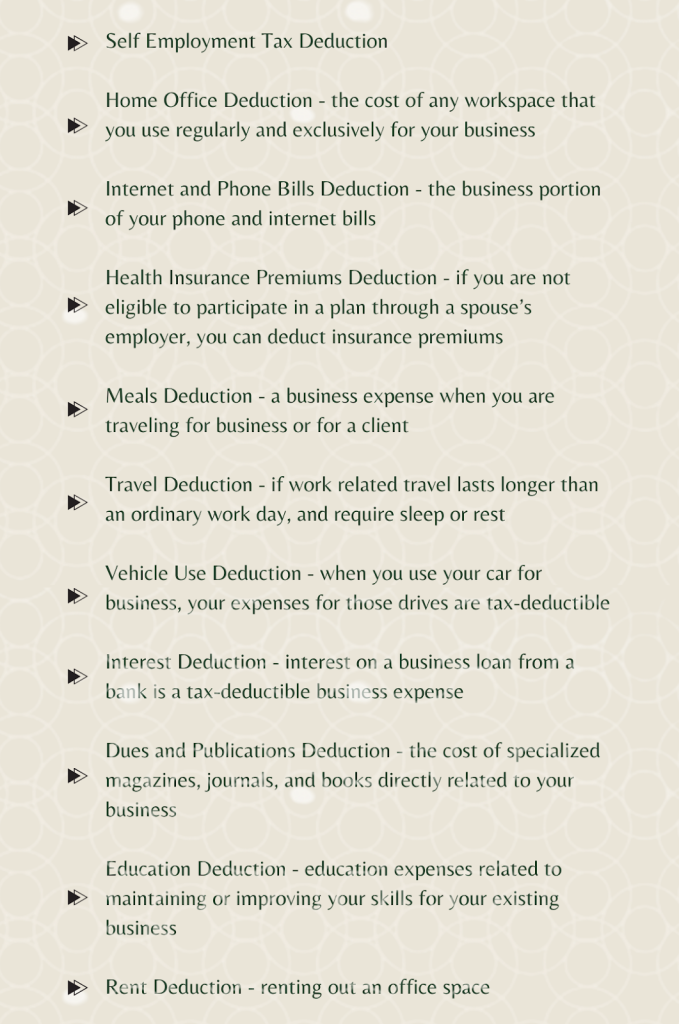

The concept of estimated tax payments for self-employed designers can be overwhelming, but it’s a fundamental aspect of financial responsibility. Don’t drive down this daunting path alone! Circaphiles is here to provide the roadmap, so you are making every important stop along the way, *beep beep!* In this blog post, we will embark on a journey to unravel the intricacies of estimated tax payments, shedding light on their importance and the vital considerations involved.

Whether you’re just starting your self-employed design career or looking to refine your financial acumen, we’ll provide practical insights and expert tips to help you budget, plan, and navigate your financial landscape with confidence!